How Was the "FICO Score" Named?

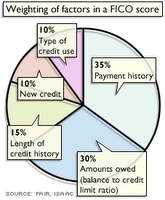

A FICO score is a credit score developed by Fair Isaac & Co. Credit scoring is a method of determining the likelihood that credit users will pay their bills. Fair, Isaac began its pioneering work with credit scoring in the late 1950s and, since then, scoring has become widely accepted by lenders as a reliable means of credit evaluation. A credit score attempts to condense a borrowers credit history into a single number. Fair, Isaac & Co. and the credit bureaus do not reveal how these scores are computed. The Federal Trade Commission has ruled this to be acceptable.

Credit scores are calculated by using scoring models and mathematical tables that assign points for different pieces of information which best predict future credit performance. Developing these models involves studying how thousands, even millions, of people have used credit. Score-model developers find predictive factors in the data that have proven to indicate future credit performance. Models can be developed from different sources of data. Credit-bureau models are developed from information in consumer credit-bureau reports. (Found Here)

Tags:

⢠BlinkBits ⢠BlinkList ⢠Blogmarks ⢠Buddymarks ⢠CiteUlike

⢠Connotea ⢠del.icio.us ⢠de.lirio.us ⢠Digg it ⢠FeedMarker

⢠feedmelinks ⢠Furl ⢠Give a Link ⢠Gravee ⢠igooi

⢠Lilisto ⢠Linkagogo ⢠Linkroll ⢠ma.gnolia ⢠Maple.nu

⢠Netvouz ⢠Onlywire ⢠RawSugar ⢠reddit ⢠Scuttle

⢠Shadows ⢠Simpy ⢠Spurl ⢠tagtooga ⢠TalkDigger

⢠Wink ⢠Yahoo MyWeb

![[Social Submit this] [Social Submit this]](http://www.socialsubmit.com/images/socialsubmit.png)

<< Home